Calculate 401k contribution per paycheck

As of 2020 the 401k contribution limit for those aged 50 and below is 19500. 401k Plan is a defined contribution plan where an employee can make contributions from his or her paycheck either before or after-tax depending on the options offered in the plan.

401k Contribution Calculator Step By Step Guide With Examples

Some employers even offer contribution matching.

. Medicare tax rate is 145 total including employer contribution. Non-exempt employees have the opportunity for a bigger paycheck by working over 40 hours per week. An employer-sponsored 401k retirement.

0 Your Take Home Pay Only Changes By. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Tax rates are dependent on income brackets.

Employer Match Percentage. Try to meet or exceed their matching amount to make the most of your retirement savings. For 2023 the total of all employee and employer contributions per employer should increase from 61000 in 2022 to 66000 in 2023 for those under 50.

The contributions go into a 401k account with the employee often choosing the investments based on options provided under the plan. 401k health insurance HSA etc. Since the catch-up contribution has increased to 7500 the total contribution for those 50 should be 73500.

The free online Average Calculator will calculate the average of any group of numbers. 2023 401k403b401a Total Contribution Limit. Aged 65 and older.

Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Use PaycheckCitys 401k calculator to see how 401k contributions impact your paycheck and how much your 401k could be worth at retirement. 290 for incomes below the threshold amounts shown in the table.

On long road trips knowing how many miles you are averaging per hour can give you an idea of how long it will take to get to your destinationIt is also a good indicator if you are taking too many breaks or if traffic has caused delays in your journey. Our Miles Per Hour Calculator can tell you how many miles you drive in a single stretch. Overview of Montana Taxes Montana has a progressive income tax system with seven income brackets that boast rates ranging from 100 to 690.

Held an approximate 65 trillion in retirement assets according to the Investment Company Institute. Miles Per Hour Definition. Your FICA taxes are your contribution to the Social Security and Medicare programs that youll have access to when youre a senior.

As of September 2020 401k plans in the US. How 401k Contributions Affect Your Paycheck. Simply enter in as long of a string of numbers to average that you like into the box and separate the numbers by a comma and then press calculate to get the average of all of the numbers.

Start your 401K investment in 1 year. This number is the gross pay per pay period. If your employer offers a 401k plan consider contributing pre-tax money with every paycheck.

Contribute to your 401k. There are a number of retirement accounts that allow you to save and invest toward your retirement goals but one of the most common in the US. Its your way of paying into.

Subtract any deductions and payroll taxes. To calculate a paycheck start with the annual salary amount and divide by the number of pay periods in the year.

Tw T2ugbrrhyxm

After Tax Contributions 2021 Blakely Walters

Solo 401k Contribution Limits And Types

401k Contribution Calculator Step By Step Guide With Examples

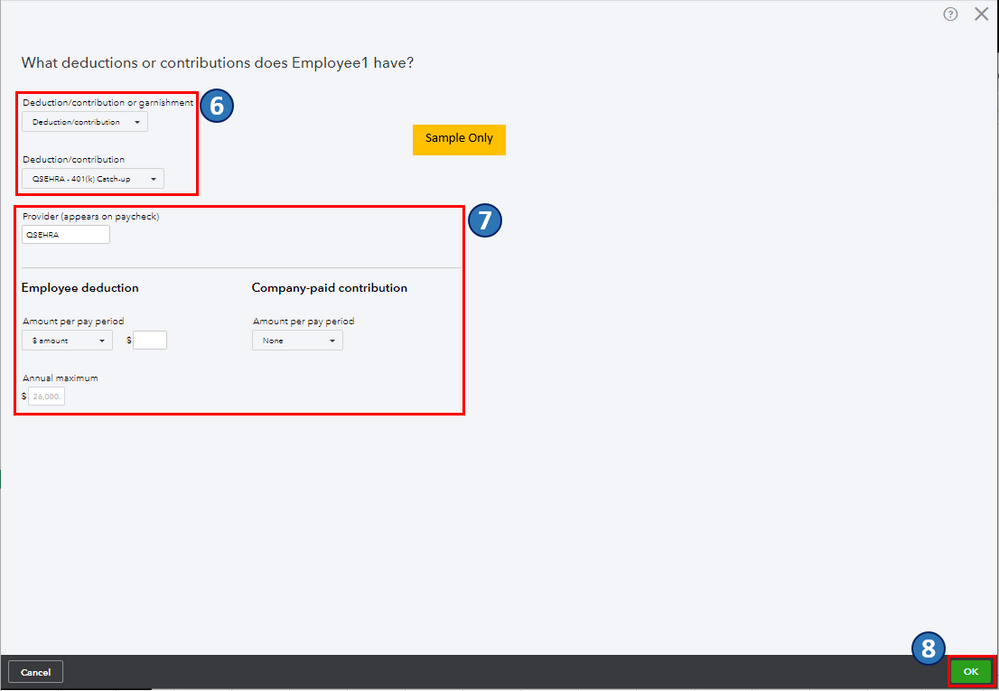

Explain How To Change The Setup Of Deduction Contribution Form Simple 401k To Simple 401k Catchup

What Is A True Up Matching Contribution

Solved After Tax Roth 401 K Employee Deductions Company Contributions

I Created A Little Calculator To Figure Out Exactly What My 401k Contribution Election Should Be To Front Load It Early Each Year Reach The Annual Max And Still Get The Full

How To Maximize Your 401 K In 2019

7 Most Valuable Ways To Save For Retirement Software Development Business Solutions Web Design Services

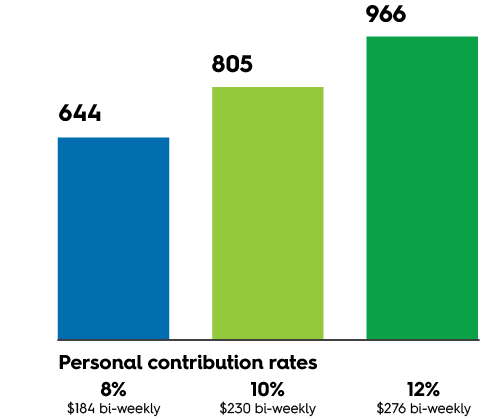

401 K Contributions How Much Is Enough Securian Financial

What Is A 401 K Match Onplane Financial Advisors

What Compensation Should We Use To Calculate Company Contributions To Our 401 K Plan

Investment Plan Worksheet Financial Planning Printables Investing Financial Planning

How Much Should I Have Saved In My 401k By Age

Catch Up Contributions How Do They Work Principal

401 K Income Limits The Mistake Executives Earning Over 305 000 Make All The Time